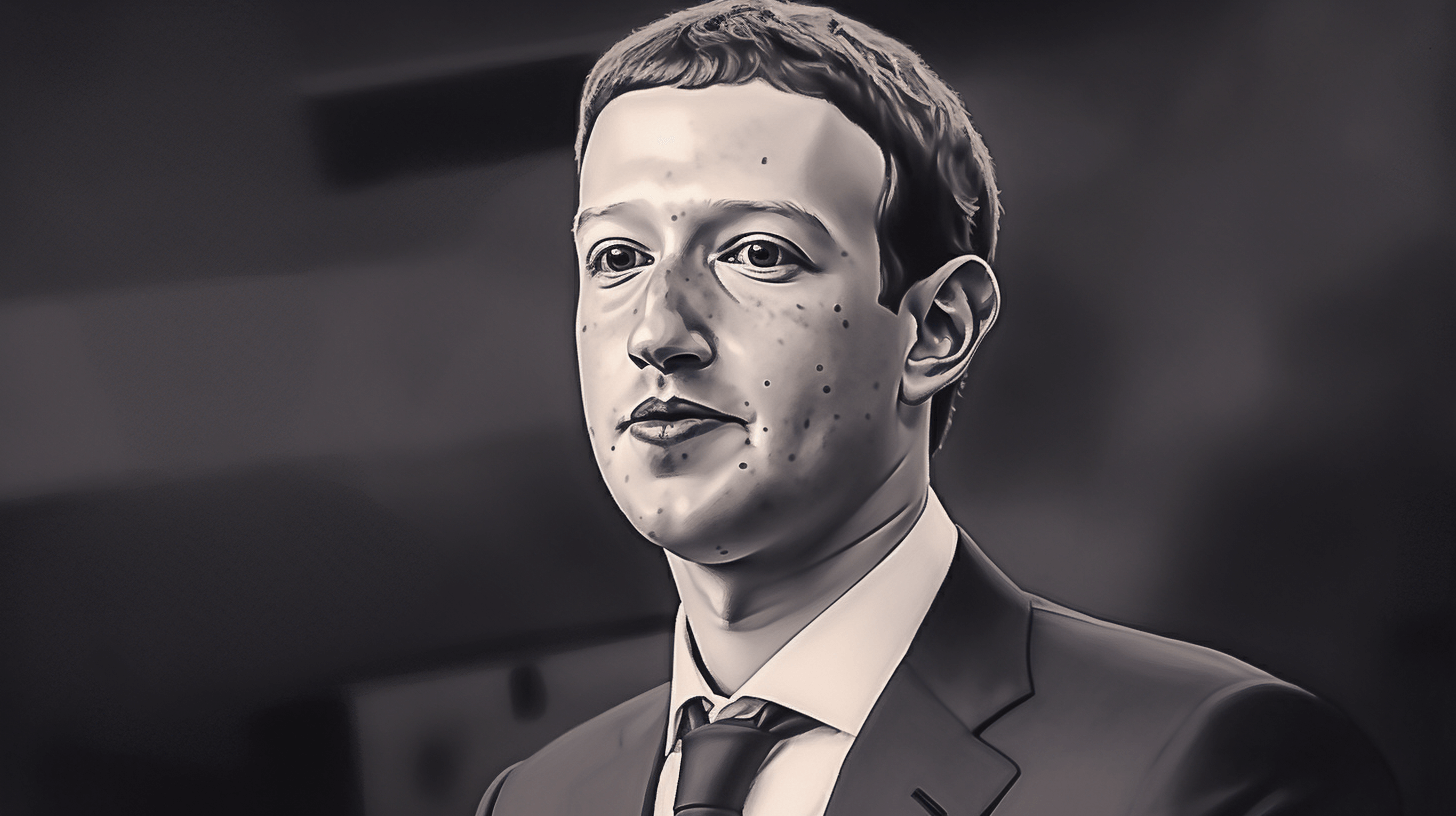

CEO Warns of Impending Real Estate Market Crisis

Da Top Financial Big Shot Wen Warn Bout Real Estate Crisis!

Da CEO from one top financial kine company stay banging da gong bout one real estate market dat goin’ get all messed up in da next couple years. He wen talk dis at da World Economic Forum wit Maria Bartiromo from FOX Business in Switzerland, saying get one big kine shift coming and plenny loans goin’ bust.

Real estate going take one heavy lickin’! We talking bout maybe $700 billion goin’ down da drain… Da lenders, dey goin’ need do somethin’ ’bout it. Gonna be heap big changes in da real estate game, end of 2024 and all da way through 2025. We goin’ see real estate flipping upside down, $700 billion to $1 trillion in defaults, no joke!

Eh, I tell you, real estate goin’ get ugly, real ugly, next 18 months, two years, he wen add.

Da Big Talk Bout Real Estate Crisis

He wen explain how da high rates goin’ wipe out plenty commercial loans.

Wat I figga goin’ happen is, da loans, nobody talking ’bout ’em, but goin’ be big business soon. ‘Cause when da mortgages on commercial buildings come due, we talking trillion bucks, next couple years with da rates so high, nobody goin’ get da cash. So, you get one $120 million loan on one building, and somebody tell you, ‘Eh, I give you $90 million but da rate stay way up,’ you goin’ give back da keys to da lenders… Real estate kine equity goin’ take one big hit, he wen say.

Da CEO Wen Open Up About Da Market

Da CEO wen tell ’em straight up how he see da market, saying people stay way too optimistic ’bout da Federal Reserve and what goin’ happen with da rates.

I thinking da rates goin’ stay da same, steady Eddie. All dis talk ’bout cutting 175 basis points, dat just way too much. Too much. Maybe 50 basis points, maybe 75. But das it. So, I thinking everybody stay goin’ overboard. People too positive ’bout da rates. I thinking we goin’ stay right around here. But das alright.

NOW IN ENGLISH

CEO Warns of Impending Real Estate Market Crisis

The CEO of a major financial company has warned about a real estate crisis. He made these remarks at the World Economic Forum in Switzerland during a conversation with Maria Bartiromo from FOX Business. He predicts significant turmoil in the real estate market over the next few years, with many loans failing.

“Real estate is going to take a heavy hit! We’re talking about possibly $700 billion going down the drain… Lenders will need to take action. There will be significant changes in the real estate industry by the end of 2024 and throughout 2025. We will see real estate flipping upside down, with defaults ranging from $700 billion to $1 trillion, no joke!

“Let me tell you, real estate is going to get ugly, really ugly, in the next 18 months, two years,” he added.

He explained how high interest rates will wipe out many commercial loans.

“What I foresee happening is that loans, which nobody is talking about, will soon become big business. Because when the mortgages on commercial buildings come due, we’re talking trillions of dollars in the next couple of years. With interest rates so high, nobody will have the cash. So, if you have a $120 million loan on a building and someone offers you $90 million but with a high interest rate, you’re going to give back the keys to the lenders… Real estate equity is going to take a big hit,” he said.

The CEO also spoke candidly about the market, stating that people are too optimistic about the Federal Reserve and interest rates.

“I believe interest rates will remain the same, steady Eddie. All this talk about cutting 175 basis points is just too much. Maybe 50 basis points, maybe 75. But that’s it. So, I think everyone is going overboard. People are too positive about the rates. I believe we will stay right around here. But that’s okay.”