🙆♀️💰📉 Yellen’s Debt Alarm No Get Hear: Now She Gotta Deal Wit Da Kaos

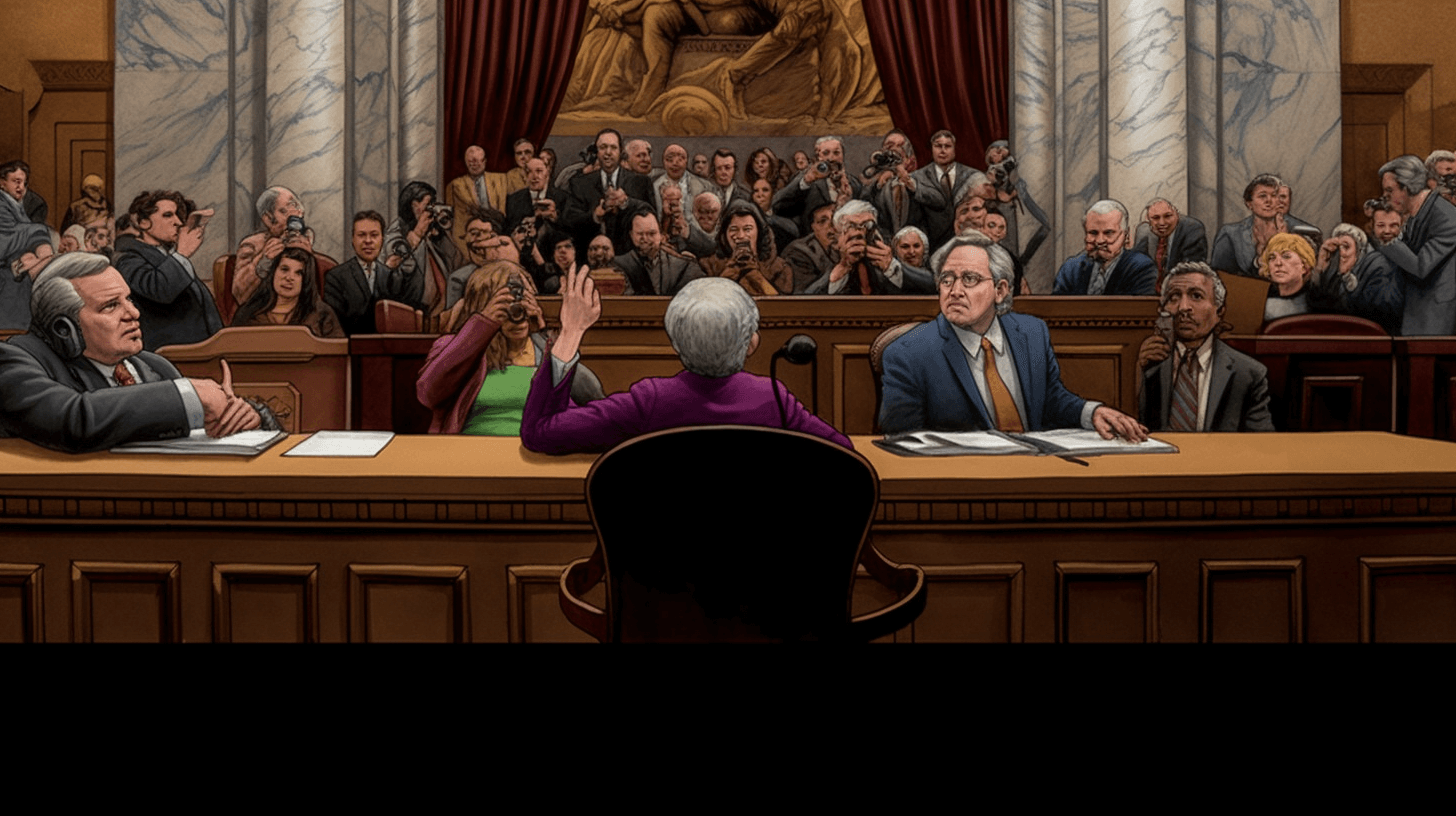

Da Treasury Secretary, Janet L. Yellen, been feelin’ sweet afta da November elections wen Democrats come out solid den expected an’ kept control of da Senate 🗳️💙. But as she wen head to da Group of 20 leaders meet-up in Indonesia, she wen get choke worry. She wen say Republicans taking ova da House could be one big pilikia for da U.S. economy 💸📉.

She always had da debt ceiling on her mind. During her flight from New Delhi to Bali, she wen urge da Democrats fo’ take action. She been like, “Democrats, you guys gotta raise da debt limit beyond da 2024 elections. If you guys can find one way fo’ make ’em happen, I’m all in!” ✈️🗣️📈.

But no listen, da Democrats wen ignore Yellen’s advice. Instead, da US been creeping closer an’ closer to defaulting as Republicans no like raise or stop da nation’s borrowing limit, which stay now at $31.4 trillion, without cutting spending an’ going against parts of President Biden’s plans 💵🐘.

Now, da federal government’s cash balance wen drop unda $40 billion. An’ Yellen told lawmakers dat da X-date — da date wen da Treasury Department run out money fo’ pay all da bills — going come by June 5 ⏰💔.

Yellen been hold her emergency plans close but she wen hint dis week dat she been thinking about how fo’ prepare fo’ da worst. If da Treasury was forced fo’ choose which bills fo’ pay first, she said she going face some “hard choices” 🤔📚.

White House guys no like say if dey been make any emergency plans. As da U.S. come more close to default, da Treasury Department no like say if dat changed 🏦🤷♀️.

But, old Treasury an’ Federal Reserve officials said it’s almost fo’ sure dat emergency plans getting ready. Da Treasury Department gotten one playbook from previous debt limit standoffs. An’ Yellen, she know ’em all cause she was one big Fed official during da last two major standoffs in 2011 and 2013 📚💡.

Yellen wen get briefed on da Treasury’s plans during those times and was part of her own discussions on how fo’ stabilize da financial system if da United States couldn’t pay all its bills on time 💼📊.

Fed officials also wen talk about steps they could take fo’ keep money markets stable and to prevent failed Treasury auctions from causing a default. Yellen said in 2011 and 2013 that she would help plans to protect the financial system 💲🛡️.

Eric Rosengren, who was da president of da Federal Reserve Bank of Boston in 2011, said in one interview dat he expected Yellen, who known fo’ being super prepared, was busy thinking about emergency plans 🏦👩💼.

As da debt ceiling standoff getting more heated, Yellen no been as involved in talks with lawmakers as some of her predecessors. Mr. Biden wen pick Shalanda Young, his budget director, and Steven J. Ricchetti, White House counselor, fo’ lead da talks with House Republicans 🏛️🤝.

Yellen been take one more behind the scenes role, giving White House updates on da nation’s cash reserves, calling business leaders and asking them to urge Republicans to lift da debt limit and sending more and more letters to Congress warning when the federal government going be unable to pay all its bills 📩⚠️.

Despite all Yellen’s work, Republicans been questioning her credibility. Dey wen write one letter to Speaker Kevin McCarthy recently asking fo’ Yellen “furnish a complete justification” of her earlier projection that the U.S. could run out of cash as soon as June 1 📝📬.

Republicans also been targeting some of Yellen’s most cherished policy priorities in the negotiations, like rolling back some of the $80 billion that the Internal Revenue Service received as part of last year’s Inflation Reduction Act 💸🔍.

When da debt limit standoff finally over, Democrats probably going get more pressure fo’ change the laws that control the nation’s borrowing the next time they control the White House and Congress. Yellen said in 2021 that she supported getting rid of the borrowing cap 📜✂️.

She said, “I believe when Congress makes laws for spending and puts in place tax policy that decides taxes, those are the important decisions Congress is making. And if to fund those spending and tax decisions it is necessary to issue more debt, I believe it is very destructive to put the president and myself, as Treasury secretary, in a situation where we might be unable to pay the bills that come from those past decisions” 🗣️🏛️.

NOW IN ENGLISH

Yellen’s Debt Alarm Goes Unheeded: Now She Must Deal with the Chaos 🙆♀️💰📉”

The Treasury Secretary, Janet L. Yellen, has been feeling optimistic after the November elections, where Democrats performed better than expected and retained control of the Senate 🗳️💙. However, as she headed to the Group of 20 leaders’ meeting in Indonesia, she grew increasingly concerned. She warned that Republicans taking over the House could pose a significant threat to the U.S. economy 💸📉.

Yellen has always had the debt ceiling on her mind. During her flight from New Delhi to Bali, she urged Democrats to take action, stating, “Democrats, you have to raise the debt limit beyond the 2024 elections. If you can find a way to make it happen, count me in!” ✈️🗣️📈.

Unfortunately, the Democrats did not heed Yellen’s advice. Instead, the United States has been inching closer to default as Republicans refuse to raise or suspend the nation’s borrowing limit, which currently stands at $31.4 trillion, without imposing spending cuts and opposing parts of President Biden’s plans 💵🐘.

Now, the federal government’s cash balance has dropped below $40 billion. Yellen informed lawmakers that the X-date—the date when the Treasury Department runs out of money to pay all the bills—will arrive by June 5 ⏰💔.

Yellen has been keeping her emergency plans under wraps but hinted this week that she has been contemplating how to prepare for the worst. If the Treasury is forced to choose which bills to prioritize, she will face some “hard choices” 🤔📚.

The White House has not disclosed whether any contingency planning is underway. As the U.S. edges closer to default, the Treasury Department has refrained from commenting on whether the situation has changed 🏦🤷♀️.

However, former Treasury and Federal Reserve officials believe that emergency plans are almost certainly being developed. The Treasury Department has a playbook from previous debt limit standoffs, and Yellen is well acquainted with them, as she was a prominent Fed official during the significant standoffs in 2011 and 2013 📚💡.

Yellen was briefed on the Treasury’s plans during those periods and engaged in her own discussions on how to stabilize the financial system if the United States couldn’t meet all its financial obligations on time 💼📊.

Fed officials also discussed measures to stabilize money markets and prevent failed Treasury auctions from triggering a default, even if the Treasury Department successfully pays its creditors. Yellen expressed her support for these plans in 2011 and 2013, emphasizing the need to protect the financial system 💲🛡️.

Eric Rosengren, who served as the president of the Federal Reserve Bank of Boston in 2011, stated in an interview that he expects Yellen, known for her meticulous preparation, to be busy considering contingency plans, just as she did at the Fed more than a decade ago 🏦👩💼.

As the debt ceiling standoff intensifies, Yellen has been less involved in negotiations with lawmakers compared to her predecessors. President Biden has appointed Shalanda Young, his budget director, and Steven J. Ricchetti, White House counselor, to lead the talks with House Republicans 🏛️🤝.

Yellen has taken on a more behind-the-scenes role, providing updates on the nation’s cash reserves to the White House, reaching out to business leaders and urging them to pressure Republicans to lift the debt limit, and sending frequent letters to Congress warning about the government’s inability to pay its bills 📩⚠️.

Despite Yellen’s efforts, Republicans have questioned her credibility. They recently wrote a letter to Speaker Kevin McCarthy, demanding that Yellen “provide a complete justification” for her earlier projection that the U.S. could run out of cash as early as June 1 📝📬.

Republicans have also targeted some of Yellen’s key policy priorities in the negotiations, including rolling back a portion of the $80 billion allocated to the Internal Revenue Service under last year’s Inflation Reduction Act. The White House appears willing to return $10 billion of those funds, intended to enhance the agency’s ability to detect tax fraud, in exchange for preserving other programs 💸🔍.

Once the debt limit standoff finally subsides, Democrats will likely face renewed pressure to overhaul the laws governing the nation’s borrowing when they regain control of the White House and Congress. Yellen expressed her support for abolishing the borrowing cap in 2021, emphasizing that Congress should focus on making spending and tax decisions rather than putting the President and the Treasury Secretary in a situation where they may be unable to pay the resulting bills 📜✂️.

“I believe when Congress legislates expenditures and establishes tax policies, those are the critical decisions Congress is making,” Yellen stated during a House Financial Services Committee hearing. “If it is necessary to issue additional debt to finance those spending and tax decisions, I believe it is very destructive to put the President and myself, as Treasury Secretary, in a situation where we might be unable to pay the bills that result from those past decisions” 🗣️🏛️.