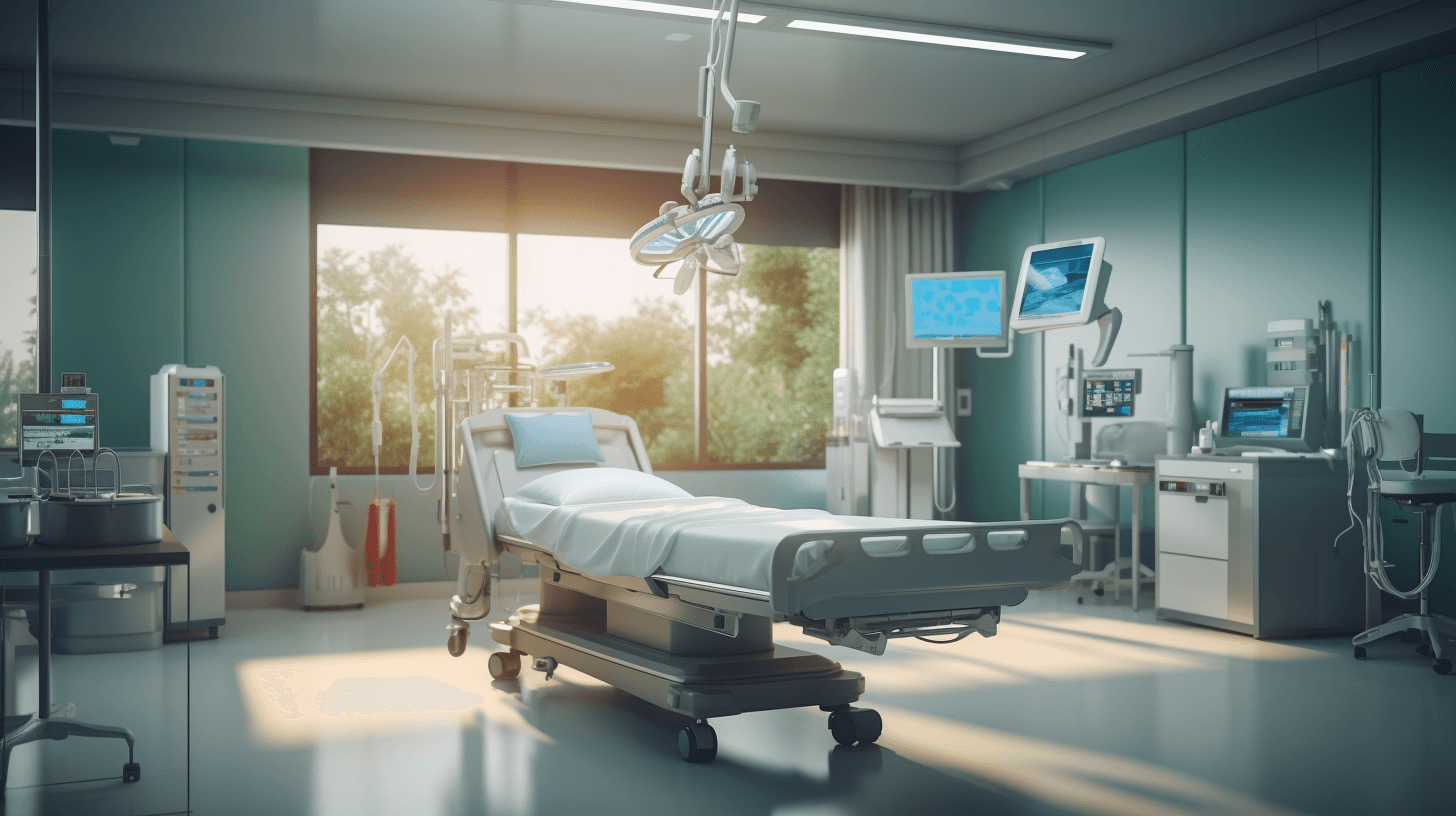

💰💔🏥 Da Nonprofit Health System Cut Off Patients Wit’ Medical Debt

Doctors at da Allina Health System, one wealthy nonprofit in da Midwest, no can see patients who pau medical bills or kids wit’ too much debt. 😷💼💸

Plenny hospitals in da United States use strong-arm tactics fo’ collect medical debt. Dey stay floodin’ local courts wit’ lawsuits fo’ collect money. Dey take people’s wages an’ tax refunds. 💔⚖️💰

But dis nonprofit health system in da Midwest go even furthah – dey no give care to patients who owe medical bills. 😷💳🚫

Allina Health System, wea get ova 100 hospitals an’ clinics in Minnesota an’ Wisconsin an’ make $4 billion in revenue every year, sometimes turn away patients who get big debt, according to inside documents an’ interviews wit’ doctors, nurses, an’ patients. 😷💼💵

While Allina hospitals go treat anybody in da emergency room, dey cut off otha services fo’ patients who get debt, even kids an’ those wit’ chronic illnesses like diabetes an’ depression. Patients no can come back until dey pay off da whole debt. 😷🚫💼

Nonprofit hospitals like Allina suppose to get big tax breaks cuz dey supposed to take care of da poorest people in da community. But one investigation from New York Times last year showed dat nonprofits nevah really fulfill deir duty an’ no get consequences fo’ dat. 💔🏥💸

Allina get one explicit policy fo’ cut off patients who owe money fo’ services dey get at da health system’s clinics. One 12-page document reviewed by New York Times tell Allina staff how fo’ cancel appointments fo’ patients who owe at least $4,500. Da policy teach dem how fo’ lock patients’ electronic health records so nobody can make future appointments. 💼🚫🗂️

“Dem da poorest patients wit’ da most serious medical problems,” said Matt Hoffman, one primary care doctor at Allina. “Dem da patients who need our care da most.” 😷💔👩⚕️

Allina Health say dey get one strong financial assistance program dat help over 12,000 patients wit’ medical bills every year. Dey only cut off patients if dey owe at least $1,500 of debt three separate times. Dey contact dem by phone an’ send lettas wit’ info about how fo’ apply fo’ financial help, said Conny Bergerson, one hospital spokeswoman. 💼💡🤝

“Allina Health always like fo’ make sure no patient go wit’out service cuz money problems,” said Ms. Bergerson. She say cuttin’ off services “rare,” but no give information on how often dat happen. 😷🏥🚫

Allina stop dis policy fo’ cut off patients in March 2020 wen da coronavirus pandemic start, but started again in April 2021. 😷🚫🦠

Around 100 million Americans get medical debts, an’ dem bills make up ’bout half of all da outstanding debt in da country. 💔💸🇺🇸

‘Round 20 percent of hospitals across da nation get policies dat let dem cancel care fo’ patients wit’ debt, according to one investigation from KFF Health News. Plenny of dose hospitals be nonprofits. Da government no keep track of how often hospitals refuse care. 💔🏥🚫

Federal law say hospitals gotta treat anybody who come to da emergency room, even if dey no can pay. But da law, called Emergency Medical Treatment an’ Labor Act, no say how hospitals gotta treat patients who need otha life-savin’ care, like those wit’ cancer or diabetes. 😷⚖️💼

Allina get big tax breaks cuz dey nonprofit, but Internal Revenue Service tell dem an’ plenny otha nonprofit hospitals dat dey gotta help da local community, like by providin’ free or low-cost care fo’ people wit’ low income. 🏥💼🌇

But da federal rules no say how poor somebody gotta be fo’ get free care. In 2020, Allina spend less than half of 1 percent of its expenses on charity care, way less than da nationwide average of ’bout 2 percent fo’ nonprofit hospitals. Dis info come from analysis by Ge Bai, one professor at Johns Hopkins Bloomberg School of Public Health. 😷🔀💼💰

Allina one of da biggest health systems in Minnesota, an’ it wen grow plenny through acquisitions. From 2013, deir profits range from $30 million to $380 million every year. Last year was da first time in da past decade dat dey lost money, mostly cuz of investment losses. 💼💸💰

Allina’s success make plenny money fo’ dem. Da president make $3.5 million in 2021, da most recent year dat get data. Dey even built one $12 million conference centa. 💼💰👨⚕️

But sometimes Allina play hardball wit’ patients. Doctors stay used to seein’ messages in da electronic medical record dat say patients “no can get care” cuz dey get “unpaid medical balances.” 😷📝💸

Dr. Rita Raverty, one primary care doctor at Allina clinic, say dose messages make her worry cuz she no can provide continuous care fo’ patients who get many health risks. 😷👩⚕️💔

“Nobody win when patients no can get preventive care,” Dr. Raverty say. “It make da diseases worse when you no catch ’em early.” 😷🏥🔄🔍

Doctors an’ patients say dey no can complete medical forms dat kids need fo’ enroll in day care or show proof of vaccinations fo’ school. 💔🏥📋👨⚕️👩⚕️

Serena Gragert, one former scheduler at Allina clinic in Minneapolis, say da computer system no let her make future appointments fo’ patients wit’ unpaid balances. 😷🗓️💻

Ms. Gragert an’ oddah Allina employees say some patients dat got cut off get low incomes an’ even qualify fo’ Medicaid, da federal-state insurance program fo’ da poor. Dat means dose patients would qualify fo’ free care undah Allina’s own financial assistance policy, but many patients no even know dat policy exist wen dey go fo’ treatment. 😷💼💰💔

Ms. Bergerson, da Allina spokeswoman, no argue wit’ dat, but say da health system go “all out” fo’ help patients wit’ deir medical care payments. 😷💼💵

Allina employees say dis policy make dem ration care. 😷🔀🤝

Beth Gunhus, one pediatric nurse practitioner, tell ’bout one case wea one muddah bring in her three kids. One had scabies, one real itchy skin condition, an’ da whole family stayin’ in one room cuz dey no can afford anythin’ bettah. Da nurse wanna treat da whole family fo’ make sure da scabies no spread mo’, but she can only write prescription fo’ two of da kids. Da account fo’ da third kid stay locked cuz of unpaid bills. 💔🏥👩⚕️

“Dea plenny oddah ways fo’ save money dan dis,” Ms. Gunhus say. 😷🏥🙅♀️💰

Allina say dis policy only apply to debts related to care at da clinics, not da hospitals. But patients say in interviews dat dey get cut off aftah gettin’ debt fo’ services at Allina hospitals. 😷💼🚫

Since Allina stay da main health system in some rural parts of Minnesota, gettin’ cut off leave patients wit’ not much options. 😷🌇🚫

Jennifer Blaido live in Isanti, one small town outside Minneapolis, an’ Allina get da only hospital dea. Ms. Blaido, one mechanic, say she get nearly $200,000 in bills from one two-week stay at Allina’s Mercy Hospital in 2009 fo’ complications from pneumonia. She also had multiple emergency room visits fo’ her asthma. Most of da hospital stay no get covered by her health insurance, an’ she no can pay off da debt. 💔💼💸

Last year, Ms. Blaido had one cancer scare, but she couldn’t get one appointment wit’ one doctor at Mercy Hospital. She had to drive mo’ dan one hour to get examined at one health system dat no get any connection to Allina. 😷🚗🌇

Allina no make dis policy clear to patients. Dey no mention dis policy in da “frequently asked questions” list ’bout billing practices. In at least one case, Allina say da policy no even exist. 😷📝🚫

In one lawsuit filed last year in state court in Minnesota, Allina sue one couple, Jordan an’ JoLynda Anderson, fo’ nearly $10,000 in unpaid medical bills. In court filings, da couple talk ’bout how Allina cancel appointments fo’ Ms. Anderson an’ tell her she no can make new ones until she set up three separate payment plans – one wit’ da health system an’ two wit’ debt collectors. 😷💼⚖️💔

Even aftah settin’ up da payment plans, which add up to $580 per month, da canceled appointments nevah get restored. Allina only let patients come back aftah dey pay da whole debt. 😷🔄💼

Ms. Anderson say she stay devastated she wen lose her appointment wit’ one endocrinologist who specialize in her chronic condition. She been waitin’ four months fo’ dat appointment, an’ now she no can get one new one. 😷🚫👩⚕️💔

Ms. Bergerson no give comments ’bout dese cases fo’ privacy reasons. 😷🤐💼

When da Andersons ask fo’ a copy of Allina’s policy fo’ cuttin’ off patients wit’ unpaid bills, da hospital’s lawyers say, “Allina no get one written policy ’bout cancellin’ services or stoppin’ scheduled an’ referral services or appointments fo’ unpaid debts.” 💼📝🚫

But da truth is dat Allina get one policy, made in 2006, dat tell employees how fo’ do exactly dat. Da policy teach staff how fo’ “cancel any future appointments da patient wen make at any clinic.” 💼🗂️🔒

Dey do provide a few ways fo’ patients fo’ keep gettin’ care even wit’ unpaid bills. One way stay gettin’ approved fo’ one loan through da hospital. Anotha way stay filin’ fo’ bankruptcy. 😷💼🏦

As dis investigation show, Allina’s policy fo’ cut off patients wit’ unpaid medical bills raisin’ concerns ’bout da fairness an’ accessibility of healthcare services. It leave da poorest patients, who often need da most care, without da support dey need. Da nonprofit status an’ da tax breaks Allina receive come wit’ da expectation dat dey serve da community an’ provide care fo’ those who can’t afford it. But da low percentage of expenses spent on charity care an’ da impact on patients show dat dere still much work to be done fo’ healthcare systems to truly prioritize da well-bein’ of all patients, regardless of deir financial situations. 💔💼🏥🌇

NOW IN ENGLISH

💰💔🏥 The Nonprofit Health System Cuts Off Patients With Medical Debt

The Allina Health System, a prominent nonprofit in the Midwest, won’t see patients with unpaid medical bills or children burdened with too much debt. 😷💼💸

Many hospitals in the United States use aggressive tactics to collect medical debt. They flood local courts with lawsuits to retrieve money. They seize people’s wages and tax refunds. 💔⚖️💰

But this Midwest nonprofit health system goes even further – they deny care to patients who owe medical bills. 😷💳🚫

The Allina Health System, which oversees over 100 hospitals and clinics in Minnesota and Wisconsin and generates $4 billion in revenue every year, occasionally turns away patients who have substantial debt, according to internal documents and interviews with doctors, nurses, and patients. 😷💼💵

While Allina hospitals will treat anyone in the emergency room, they withhold other services from patients who have debt, including children and those with chronic illnesses like diabetes and depression. Patients are not allowed to return until they settle the entire debt. 😷🚫💼

Nonprofit hospitals like Allina are supposed to receive significant tax breaks because they are expected to provide care for the poorest people in the community. However, an investigation from the New York Times last year revealed that nonprofits rarely fulfill their obligations and face no repercussions for that. 💔🏥💸

Allina has an explicit policy to cut off patients who owe money for services they received at the health system’s clinics. A 12-page document reviewed by the New York Times guides Allina staff on how to cancel appointments for patients who owe at least $4,500. The policy instructs them on how to lock patients’ electronic health records so nobody can schedule future appointments. 💼🚫🗂️

“These are the poorest patients with the most serious medical problems,” said Matt Hoffman, a primary care doctor at Allina. “These are the patients who need our care the most.” 😷💔👩⚕️

Allina Health claims they have a robust financial assistance program that helps over 12,000 patients with medical bills every year. They only cut off patients if they owe at least $1,500 of debt on three separate occasions. They contact them by phone and send letters with information on how to apply for financial help, said Conny Bergerson, a hospital spokeswoman. 💼💡🤝

“Allina Health always strives to ensure no patient goes without service due to financial issues,” said Ms. Bergerson. She said cutting off services is “rare,” but didn’t provide data on how frequently it occurs. 😷🏥🚫

Allina halted this policy to cut off patients in March 2020 when the coronavirus pandemic began, but resumed it in April 2021. 😷🚫🦠

Around 100 million Americans have medical debts, which comprise about half of all the outstanding debt in the country. 💔💸🇺🇸

Approximately 20 percent of hospitals nationwide have policies that allow them to cancel care for patients with debt, according to an investigation from KFF Health News. Many of these hospitals are nonprofits. The government doesn’t keep track of how often hospitals refuse care. 💔🏥🚫

Federal law requires hospitals to treat anyone who arrives at the emergency room, even if they can’t pay. But the law, known as the Emergency Medical Treatment and Labor Act, doesn’t dictate how hospitals should treat patients who need other life-saving care, like those with cancer or diabetes. 😷⚖ from previous assistant<|im_sep|>The Nonprofit Health System that Denied Patients with Medical Debt” 💰💔🏥

Physicians at the Allina Health System, a wealthy nonprofit in the Midwest, no longer provide services to patients who have outstanding medical bills or children with excessive debt. 😷💼💸

Numerous hospitals across the United States employ aggressive strategies to collect medical debt. They flood local courts with lawsuits for the purpose of recouping funds, seizing people’s wages and tax refunds. 💔⚖️💰

However, this particular nonprofit health system in the Midwest goes even further – they withhold care from patients who owe medical bills. 😷💳🚫

The Allina Health System, which operates over 100 hospitals and clinics in Minnesota and Wisconsin and generates $4 billion in revenue annually, sometimes refuses service to patients who have large debts, according to internal documents and interviews with doctors, nurses, and patients. 😷💼💵

While Allina hospitals provide emergency room treatment to anyone, they cut off other services for patients in debt, including children and individuals with chronic diseases such as diabetes and depression. These patients cannot return until their entire debt is paid off. 😷🚫💼

Nonprofit hospitals like Allina are supposed to provide substantial tax benefits because they are expected to cater to the poorest members of the community. However, an investigation by the New York Times last year revealed that nonprofits seldom fulfill this responsibility and face no repercussions for this failure. 💔🏥💸

Allina has an explicit policy to deny service to patients who owe money for services they received at the health system’s clinics. A 12-page document reviewed by the New York Times advises Allina staff on how to cancel appointments for patients owing at least $4,500. The policy instructs them on how to block patients’ electronic health records to prevent future appointments. 💼🚫🗂️

“These are the poorest patients with the most serious medical problems,” stated Matt Hoffman, a primary care doctor at Allina. “These are the patients who need our care the most.” 😷💔👩⚕️

Allina Health claims to have a robust financial assistance program that aids over 12,000 patients with medical bills each year. They only deny service to patients if they accumulate at least $1,500 of debt three separate times. They contact these individuals by phone and send letters providing information about how to apply for financial assistance, according to Conny Bergerson, a hospital spokeswoman. 💼💡🤝

“Allina Health is always committed to ensuring no patient goes without service due to financial difficulties,” said Ms. Bergerson. She stated that cutting off services is “rare,” but didn’t provide details on the frequency of these occurrences. 😷🏥🚫

Allina suspended this policy of denying service to patients in March 2020 when the coronavirus pandemic began, but it was reinstated in April 2021. 😷🚫🦠

Approximately 100 million Americans have medical debts, which constitute about half of all the outstanding debt in the country. 💔💸🇺🇸

Around 20 percent of hospitals nationwide have policies that allow them to cancel care for patients with debt, according to an investigation by KFF Health News. Many of these hospitals are nonprofits. The government does not monitor how frequently hospitals deny care. 💔🏥🚫

Federal law requires hospitals to treat anyone who comes to the emergency room, even if they can’t pay. However, the law, known as the Emergency Medical Treatment and Labor Act, doesn’t specify how hospitals should treat patients who require other life due to volume… The policy advises them how to block patients’ electronic health records to prevent future appointments from being scheduled. 💼🚫🗂️

“These are the poorest patients with the most serious medical problems,” said Matt Hoffman, a primary care doctor at Allina. “They are the patients who need our care the most.” 😷💔👩⚕️

Allina Health says they have a robust financial assistance program that aids over 12,000 patients with their medical bills annually. They only discontinue services for patients who owe at least $1,500 of debt three separate times. They reach out to these patients by phone and mail with information about how to apply for financial assistance, stated Conny Bergerson, a hospital spokeswoman. 💼💡🤝

“Allina Health is committed to ensuring no patient is deprived of service due to financial constraints,” said Ms. Bergerson. She claims the suspension of services is a rare occurrence but didn’t provide data on its frequency. 😷🏥🚫

Allina suspended this policy of discontinuing services in March 2020 at the onset of the coronavirus pandemic, but it was reinstated in April 2021. 😷🚫🦠

Around 100 million Americans have medical debts, and these bills constitute roughly half of all the outstanding debt in the country. 💔💸🇺🇸

Approximately 20 percent of hospitals across the country have policies that allow them to discontinue care for patients with debt, according to an investigation by KFF Health News. Many of these hospitals are nonprofits. The government does not keep track of how often hospitals refuse care. 💔🏥🚫

Federal law mandates hospitals to treat anyone who comes to the emergency room, regardless of their ability to pay. However, the law, known as the Emergency Medical Treatment and Labor Act, does not dictate how hospitals must treat patients who need other forms of lifesaving care, such as those with cancer or diabetes. 😷⚖️💼

Allina receives significant tax benefits because they are a nonprofit, but the Internal Revenue Service has instructed them, along with many other nonprofit hospitals, that they must serve the local community, such as by providing free or low-cost care for low-income individuals. 🏥💼🌇

But federal rules do not specify how poor someone must be to receive free care. In 2020, Allina spent less than half of 1 percent of its expenses on charity care, which is considerably less than the nationwide average of about 2 percent for nonprofit hospitals. This information comes from an analysis by Ge Bai, a professor at Johns Hopkins Bloomberg School of Public Health. 😷🔀💼💰

Allina is one of the largest health systems in Minnesota, and it has expanded significantly through acquisitions. From 2013, their profits ranged from $30 million to $380 million each year. Last year marked the first time in the past decade that they suffered a loss, primarily due to investment losses. 💼💸💰

Allina’s success generates a substantial income for them. The president earned $3.5 million in 2021, the most recent year for which data is available. They even constructed a $12 million conference center. 💼💰👨⚕️

But sometimes, Allina plays hardball with patients. Doctors are accustomed to seeing notes in the electronic medical record stating patients “cannot receive care” due to “unpaid medical balances.” 😷📝💸

Dr. Rita Raverty, a primary care doctor at an Allina clinic, says such notes are a cause for concern. “I don’t know what happens to these patients,” she said. “I worry about them.” 👩⚕️💔🚫

The effect of such policies on patients is far-reaching and extends beyond simply the physical health complications they may encounter due to withheld treatment. Being in medical debt can be a deeply stressful and frightening experience, leading to serious mental health issues such as anxiety and depression. 💔😰🌪️

The medical community and advocacy groups have expressed increasing concern over this issue, calling for comprehensive healthcare reform that includes better protections for patients from aggressive debt collection practices. Health should not be a privilege limited to those who can afford it, they argue, but a fundamental human right. 💡🏥🌍